Contents

One of the most poignant differences between forex and stock markets is the sheer volume or size. The forex market volume dwarfs all the world’s stock markets combined, which average roughly daily volumes of $5 trillion and $200 billion, respectively. The forex market’s rapid growth potential is namely because traders of it can buy and sell currency pairs via electronic platforms constantly. It’s the difference between the buy and sell price that goes to the platform to cover its costs. Generally, the more liquid the market is for a specific stock or currency pair, the smaller the spread. So, the sheer volume of forex trading gives it the advantage in liquidity, especially over some smaller stocks that are traded less frequently.

Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price for a trade. A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined. In a position trade, the trader holds the currency for a long period of time, lasting for as long as months or even years. This type of trade requires more fundamental analysis skills because it provides a reasoned basis for the trade. In its most basic sense, the forex market has been around for centuries.

A popular topic for the forex vs stocks debate refers to market volatility. This measures price fluctuations within the markets that can either help traders to gain profits if the trade is executed effectively, or losses if the trade is not successful. Forex traders in particular often look for high liquidity within the market, as this means that an asset can be bought and sold rapidly without having much of an effect on its price. Therefore, it is likely that high market volatility is more beneficial for short-term traders. Many forex strategies work to open and close positions in a short period of time, with the intention of making a profit from small price movements when the market is particularly volatile. Today, almost every country has its own currency, with the exception of countries with a common currency or countries that have adopted a foreign currency .

For example, both the forex and the stock markets are fully-developed and regulated markets around the world. They have millions upon millions of active traders and investors, with their numbers growing in the past several years. The forex market is FXTM Forex Broker Review generally not a good investment strategy for novice and retail investors. While there’s nothing wrong with trying this market out if you have money you can afford to lose, be very careful before investing a meaningful segment of your portfolio.

FXCM: A LEADING CFD & FOREX BROKER

Whether experienced or novice, all traders need to understand the fundamental differences between forex and stock markets. Doing such will enable one to determine which market works best for them in order to maximize their returns. Overall, both markets are extremely profitable, and grasping how to trade each one will greatly expand one’s personal knowledge within the world of trading. Below, please find important information about forex versus stocks. The forward and futures markets are primarily used by forex traders who want to speculate or hedge against future price changes in a currency.

FXCM Celebrates it’s 20th anniversary and says thank you for continuing to trade with us. “At FXCM, we’ve been serving our clients for over 20 years. In that time, the world of Forex trading has changed a lot.” To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available.

That means a trader should not have a problem with buying and selling a currency, especially if they trade popular currency pairs. But even with more exotic currencies, there should be at least somebody willing to buy or sell them as the Forex works globally around o’clock. Deciding which of these financial markets to trade does not have to be complicated, and many factors can be considered in order to make the best choice. As you can see, financial markets are closely interconnected and the differences between trading the individual markets can be quite significant at times.

When deciding between forex and the stock market, it is important to identify all the opportunities available to you – notably, can you short sell? The ability to short a market opens you up to a whole new dimension of market movements, enabling you to speculate on both rising and falling markets. Trading volatility can potentially provide a lot of opportunities for traders to profit, but it also comes with increased risk, making it important to take steps to prevent unnecessary loss. Liquidity is the ease at which an asset can be bought or sold in a market. But with forex, the focus tends to be far wider, as a more complex range of factors can impact market pricing.

Why Hong Kong is a Great Place for USD & HKD

Opposingly, the foreign exchange market is a financial trading market where global currencies are traded against one another by pairs. It is generally considered one of the most fluid and growing markets of the modern era, primarily due to the high demand for foreign currency exchange worldwide. One of the main traits that separate this market from others is the fact that it is based on a decentralized system.

What is a forex trader salary?

The salaries of Foreign Exchange Traders in the US range from $29,734 to $790,251 , with a median salary of $142,040 . The middle 57% of Foreign Exchange Traders makes between $142,040 and $356,880, with the top 86% making $790,251.

Currencies are traded in OTC markets, where disclosures are not mandatory. Large liquidity pools from institutional firms are a prevalent feature of the market. One would presume that a country’s economic parameters should be the most important criterion to determine its price. A 2019 survey found that the motives of large financial institutions played the most important role in determining currency prices.

If you want to make short-term stock trades, you can do that as well, but you should not expect major price changes on a daily basis. Forex has the advantage here, as well, as people always look to buy or sell foreign currencies, whether for use or trading purposes. Of course, markets with high trading volumes are by default more liquid.

Appendix 1B The Top Foreign Exchange Dealers

First of all, the stock market is a type of financial market where investments of stocks or shares of a company are traded. Typically, companies will list how many shares an investor can purchase either publicly or privately. Publicly traded companies are traded on a stock exchange, such as the New York Stock Exchange, and sometimes through indices such as the Nasdaq.

Full BioJean Folger has 15+ years of experience as a financial writer covering real estate, investing, active trading, the economy, and retirement planning. She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004. As forex trading involves buying one currency and selling another, traders have always been able to access falling markets.

Commodity Markets

Test drive the thinkorswim platform and practice your trading strategies without putting any real money on the line. Trade forex securely and conveniently at your fingertips with the thinkorswim mobile app. Place trades, access technical studies and drawings on charts, explore education, and chat support all right on your mobile phone.

The more money you have, the more you can buy, and if you get it right, the more you can earn once the price moves favorably. Of course, you can also lose more if you get it wrong, and the price actually falls instead of growing. These days, when trading and investing are as easy as making a few clicks on your computer, the question of which of these you can go for becomes irrelevant. The new question is which one you should go for, and that is what we are going to explore today. AMTD Digital, a Chinese tech firm, is seeing its shares soar ever since its IPO last month.

It will also be hard to let go of the advantages of FX trading over stocks too quickly. Most traders still apply their Forex strategies to stock trading and end up losing a bit in the beginning. This is natural, traders get adjusted to their new patterns as they go. Therefore, don’t think that just because one asset is riskier than the other, you’ll be safe with the less risky one. No matter how we look at it, financial markets are a very hard thing to navigate, regardless of whether you’re trading Forex vs stocks, and usually result in a loss rather than a win. Long-time investments – stocks are usually bought as long-term investments.

Money transfer

However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. Foreign exchange is traded in an over-the-counter market where brokers/dealers negotiate directly with one another, so there is no central exchange or clearing house. The biggest geographic trading center is the United Kingdom, primarily London. In April 2019, trading in the United Kingdom accounted for 43.1% of the total, making it by far the most important center for foreign exchange trading in the world.

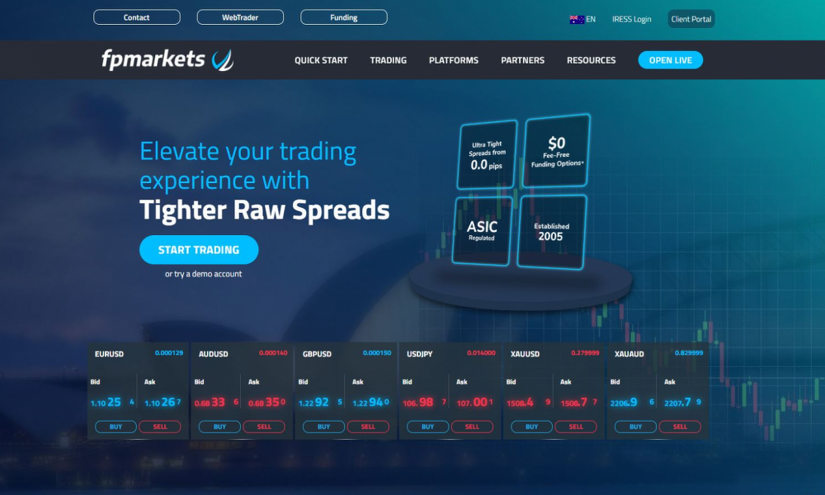

The volume in each market is moving to opposite ends of the spectrum. In other words, volume in the Forex market is flourishing while volume in the stock market is slowing. Forex has been growing steadily for the past 15 years, while the stock market has returned to pre-2006 volume. Heck, I still invest in stocks every month, but when it comes to trading I choose Forex over the stock market every day of the week. So, whether you’re new to online trading or you’re an experienced investor, FXCM has customisable account types and services for all levels of retail traders. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services.

In contrast, long-term traders that prefer a buy-and-hold method may be less comfortable in a volatile environment. Given that certain blue-chip stocks are known for their stability within the stock market, traders are more likely to open positions with a potential for profit in the long-term. Therefore, as they are not looking for short-term price fluctuations, a volatile market would not work for their trading strategy. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. A large difference in rates can be highly profitable for the trader, especially if high leverage is used.

Forex refers to “foreign exchange,” or more clearly the global currency trade. Stock markets, on the other hand, are defined as being where buyers and sellers trade equity of companies. The forex market and stock markets represent two of the most popular avenues for investment in the world. Both can take different forms, and be accessed by way of a variety of brokers and trading platforms. But both allow people to invest in the value of heavily traded, popular assets. For example, one of the bigger differences lies in the availability of the market.

When it comes to the average cost of trading stock online, one study concluded that the average fee per trade, if you were to trade on your own, would be around $8.90. Of course, the fees vary from platform to platform, but the lowest one was at around $5, while the highest one sat at almost $20. When it comes to stocks, you need to research the firm whose shares you are buying, study how to trade inside bar its roadmap, its reputation, its officials’ reputation, its partners — basically everything. If you are more interested in short-term trading, then forex is a much better way to go. Shares of SoFi Inc. were up nearly 3% in after-hours trading Tuesday after the company beat expectations with its latest results and delivered an upbeat earnings forecast for the current quarter.

However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. The combined resources of the market can easily overwhelm any central bank. Several scenarios of this nature were seen in the 1992–93 European Exchange Rate Mechanism collapse, and in more recent times in Asia. During the 1920s, the Kleinwort family were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant FX traders. By 1928, Forex trade was integral to the financial functioning of the city. Continental exchange controls, plus other factors in Europe and Latin America, hampered any attempt at wholesale prosperity from trade for those of 1930s London.

support and resistance strategy

As a result, the base currency is always expressed as 1 unit while the quote currency varies based on the current market and how much is needed to buy 1 unit of the base currency. Stocks are traded during the specific hours when the exchange where the stock is listed operates. There are also derivative markets for both currencies and technical analysis fundamentals stocks which can sometimes change the rules of trading. But this guide focuses mostly on the most basic trading in currencies and stocks. Cryptocurrencies are essentially just digital money, digital tools of exchange that use cryptography and the aforementioned blockchain technology to facilitate secure and anonymous transactions.

Built from feedback from traders like you, thinkorswim web is the perfect place to trade forex. Its streamlined interface places tools most essential to trades at center-stage and allows you to access your account anywhere with an internet connection. The stock market, on the other hand, typically has much smaller leverage. That makes it a comparatively safer market for unsophisticated traders.